Happy New Year, Wishing a joyful holiday season and a New Year filled with prosperity, growth, and continued success

The New Silk Road

The New Silk Road rail route is a vital connection between Asia and mainland Europe. Its most important developments in recent years have been in Asia. For example, Khorgos in Kazakhstan has become the central transhipment gateway. Countries in Central Europe, such as Poland, the Czech Republic, and Hungary, have also become more accessible by rail.

What is the impact of the EU sanctions against Russia?

Russia’s invasion of Ukraine and the EU sanctions against Russia are affecting rail freight transport on the New Silk Road. This is because a key part of the route runs through Belarus and Russia.

The sanctions against Russia are keeping businesses from transporting goods by train. Several freight forwarders no longer transport goods over the northern part of the New Silk Road, through Russia and Belarus. Businesses that do, may still have problems insuring the goods.

An alternative rail option is the southern part of the New Silk Road, via the Caspian Sea. This journey takes longer. The rail connection runs from China to Türkiye via Altynkol (Kazakhstan), Baku (Azerbaijan), and Tbilisi (Georgia). Or you can opt for sea freight. Although the lack of available containers is a problem

New Silk Road routes

The Chinese government is investing billions under the name ‘Belt and Road Initiative’ (BRI), building connecting routes with the West to promote economic growth. The New Silk Road development breathes new life into the original Silk Road trade routes. It offers modern logistics connections over land and sea.

The New Silk Road takes its name from silk, the shiny textile that is said to have kickstarted trade between East and West more than 2,000 years ago. The so-called Silk Routes formed an ancient trade network for many lucrative commodities.

The New Silk Road route reaches most countries in Eurasia and some countries on the east coast of Africa. It covers a distance of 10,000 to 12,000 km over 3 main routes:

The northern route operates via Russia, connecting to northeastern China (the regions around Shenyang, Suzhou, Dalian, and Beijing).

The other northern route operates via Belarus, Russia, and Kazakhstan, connecting to Khorgas in China.

The longer southern route operates via Türkiye, Armenia, Azerbaijan, Turkmenistan, Uzbekistan, Kazakhstan, and central China (the regions around Chengdu, Chongqing, and Zhengzhou).

Compare train versus ship

Transport by rail and by ship almost always takes place with containers. Due to the large temperature differences in rail transport, these are often refrigerated containers.

The train journey is faster, taking 15 to 18 days. A ship takes 35 to 55 days. The shorter transport time enables you to respond more quickly to changing market requirements. An advantage if you supply consumer products.

A ship offers economies of scale. A modern container ship, for example, has room for more than 20,000 containers. A train carries around 84 containers.

Challenges faced by the New Silk Road

The New Silk Road is developing and gaining in popularity, but its challenges include:

Differences in safety systems and voltages on the tracks in different countries.

Additional transhipment in Kazakhstan. All containers are transferred from Russian trains to wagons with a Chinese track gauge. The 2 types are not currently compatible.

Rail capacity in Northwestern Europe is under pressure. This network is busy and priority is often given to passenger trains.

Customs checks at European borders take a long time. This is especially true at the Poland-Belarus border and Schengen/non-Schengen borders.

The trains coming from China are always full. This is not the case from Europe to China.

SOURCE: kvk.nl

BoxBay

BoxBay represents a new and intelligent High Bay Storage (HBS) system, with a pilot project underway at Jebel Ali Terminal 4. It is a new international joint venture by DP World and industrial engineering specialists, SMS Group, that aims to change the way that containers are handled in ports with smart innovation.

With the use of a disruptive technology, the patented design and rack structure of BoxBay creates unique advantages with containers stored up to eleven stories high, delivering the capacity of a conventional terminal in a third of the surface area.

Scalable to any location and fully automated with direct access to each container, BOXBAY eliminates unpaid and unproductive reshuffling. It enables significant gains in handling speed, energy efficiency, safety and a major reduction in operating costs. This new revolutionary technology is set to handle metal products that weigh as much as 50 tonnes each in racks as high as 50 metres.

source: dpworld.com

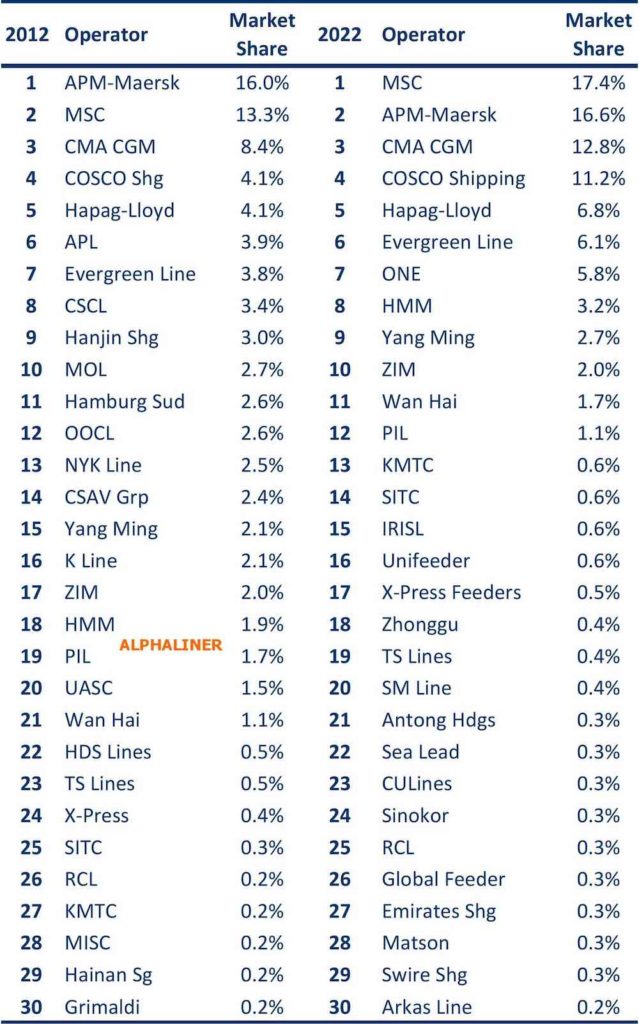

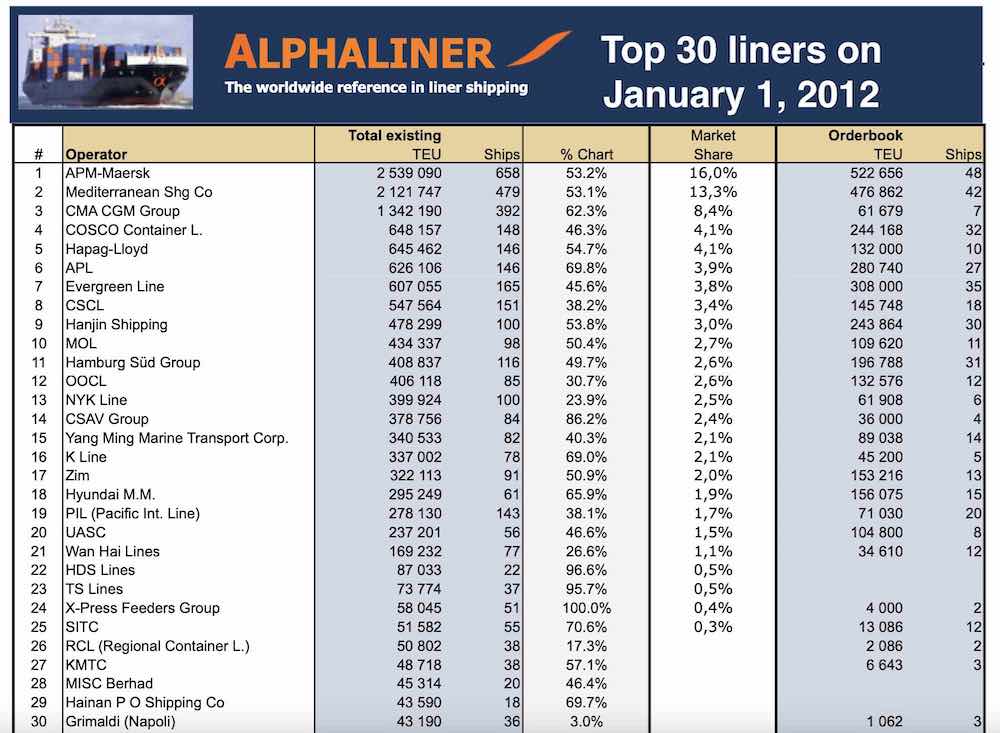

Capacity size gap between the largest carriers and the rest of the field now bigger than ever

The capacity size gap between the largest carriers and the rest of the field is now bigger than ever, according to data carried in the latest weekly report from Alphaliner.

Today, the top 10 carriers operate 21.8m teu, versus 2.5m teu for the next 20 ranked lines, a far cry from the fragmented liner line-up a decade ago (see charts at bottom for 2012 rankings).

“Following widespread consolidation at the top of the table – consolidation that has attracted the attention of politicians and regulators – there is now a large gap between the leading carriers and the rest of the container field,” Alphaliner stated.

Larger lines have earned more proportionally too during the pandemic, Alphaliner data shows.

Earnings for medium and small lines typically increased by between 100% and 700% between 2019 and 2021. By contrast in the same period the top 10 carriers increased their profits by between 1,000% and nearly 6,000%, something that has raised the ire of shippers and politicians around the world with US president Joe Biden even going so far as to say earlier this summer that he’d like to have a “pop” at the global carriers.

Commenting on the potential for the gap between the top 10 and the rest to grow in the coming years, Splash columnist Kris Kosmala said: “I think the biggest carriers have the biggest cash reserves and they will spend their money on buying more ships, essentially squeezing the smaller players to the point that maybe they will hoist white flags.”

Discussing the Alphaliner statistics with Splash, Olaf Merk, shipping expert at the OECD-affiliated think tank International Transport Forum (ITF), warned that such dominance has led to serious monopoly concerns.

Merk, a high profile campaigner against what he sees as liner shipping’s shift towards an oligopolistic market led by three consortia, said: “In well functioning markets, new firms – price fighters – will emerge to provide alternatives to the high prices of the established firms. In container shipping this does not seem to be happening. The consolidation of the biggest firms continues – as the data from Alphaliner shows – and the capacity of firms that are newly entering the container market is less than 0.5% of the total capacity – as our own data shows.”

It is not just the size of the global carriers themselves that has sparked concern with regulators and shippers alike during container shipping’s epic earnings run through the pandemic. The nature of the global alliances has also faced scrutiny. The three main global liner alliances account for more than 90% of all boxes shifted on the main east-west tradelanes.

Parash Jain, HSBC’s global head of shipping and ports research, discussed liner shipping’s stronger bargaining position thanks to consolidation last week in conversation with Splash.

“Going forward, we argue that after years of consolidation and the formation of mega shipping alliances, the shipping lines have learnt the capacity discipline and while there might still be volatility in freight rates, the rock-bottom level of freight rates seen in the past decade might no longer persist in the future,” Jain said.

Investigations by the US, the EU and others have repeatedly dismissed cartel claims over the past two years of extreme profit making for global container lines, but shippers continue to fight their case – most recently a gourmet food producer from Illinois suing Asian carriers Yang Ming and HMM over collusion claims.

source: splash247.com

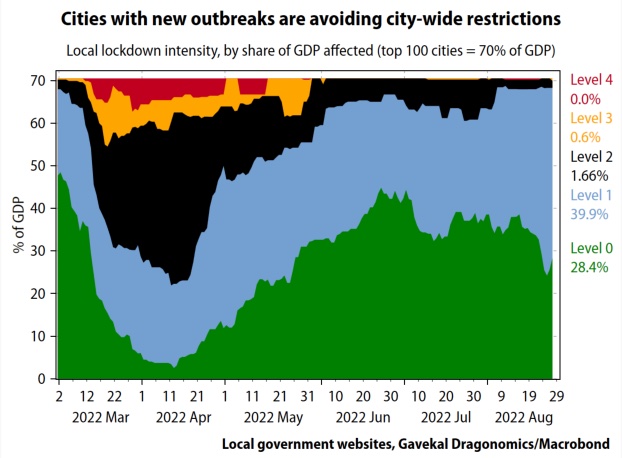

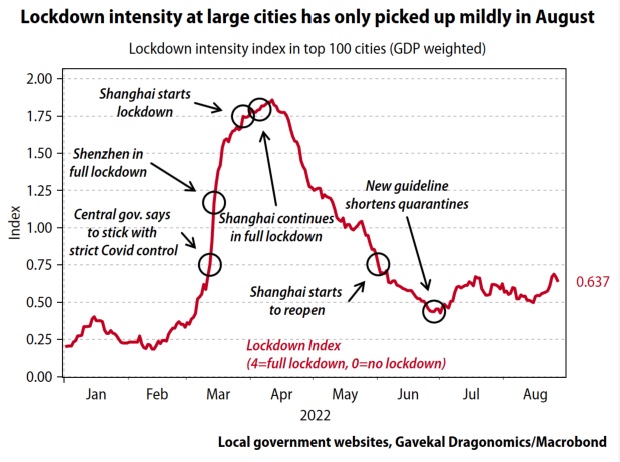

Port congestion in mainland China continued to remain high with extended lockdown measures

As COVID-19 lockdown measures were extended from Shanghai to more Chinese cities including parts of Beijing, port congestion rebounded in northern Chinese ports. Moreover, many vessels are trying to find alternative ports since social restrictions in major cities in east China including Shanghai are expected to continue into early May. This will likely increase congestion in southern ports as well.

According to Commodities at Sea, S&P Global Market Intelligence, total congestion level at ports of Shanghai has increased by about 30-40% as of April 25 since the start of March 2022, but it is still lower than the peak of last year over the third quarter. Since manufacturing sector in mainland China has been also affected because of the lockdowns and labor shortage, Chinese import and export growth has been reduced from year-ago level. According to S&P Global Market intelligence AIS data, vessel capacity arrivals into Chinese ports to load or discharge cargo have decreased by 11% to about 1.15 billion deadweight in the first quarter of 2022 from about 1.28 billion deadweight from first quarter of 2021.

Since mainland China is exporting less container-related cargo with lockdown measures, freight rates for containers and small bulkers have been softening. High demand for exports in mainland China, along with tight container capacity was affecting general bulk cargo flow with de-containerized trend. Some general cargo that was typically shipped in a container box, including steel, aluminum, fertilizer and bagged cargo, have been shipped on general cargo ships and small geared bulk vessels.

Also, lesser export volume from mainland China eased congestion on discharging ports, including US container ports. However, once COVID-19-related lockdown measures are lifted in mainland China along with seasonal recovery of shipments, the impact may pose another upside risk on port congestion in the discharging port side over the coming peak season.

Source: S&P Global Market Intelligence

Ship fuel spikes to historic $1,000/ton mark as war fallout worsens

UPDATED: VLSFO at top 20 ports hits $987/ton, Singapore: $1,001, Fujairah: $1,024

The price of ship fuel was flirting with a new record even before Russia invaded Ukraine. Then war broke out, and the highs of the past were left far behind. Ship fuel costs have “gone parabolic,” said Braemar ACM Shipbroking

To the extent the fuel cost increase is passed along to the shippers of containerized goods and bulk commodities such as oil and grain, it will add to inflation. To the extent it’s not passed on, it will lower shipping’s bottom line

Ships consumed high sulfur fuel oil (HSFO) until the IMO 2020 environmental regulations went into force two years ago. Since Jan. 1, 2020, ships have been required to burn more expensive fuel with 0.5% sulfur content known as very low sulfur fuel oil (VLSFO). Ships equipped with exhaust-gas scrubbers can continue to burn HSFO, which has a sulfur content of 3.5%

According to Ship & Bunker, the average price of VLSFO at the world’s top 20 bunker (marine fuel) ports reached $987 per ton on Tuesday, up 84% year on year. In two of the top four ports — Singapore and Fujairah, United Arab Emirates — the price of VLSFO reached $1,001 and $1,024 per ton, respectively. These price levels are unprecedented

Chart: American Shipper based on data from Ship & Bunker

The previous average daily high for VLSFO at the top 20 ports — $693.50 per ton — was recorded by Ship & Bunker on Jan. 8, 2020, at the height of the IMO 2020 transition. Before that regulation came into effect, HSFO reached highs of $746 per ton in March 2012 and around $750 per ton in July 2008.

It’s not just the price of marine bunkers that’s rising: The spread between VLSFO and HSFO is also increasing, a particularly important development for tanker and dry bulk trades. On spot voyage deals, owners pay for fuel. Some ships have scrubbers and burn cheaper HSFO; the majority don’t and must use VLSFO.

As of Tuesday, Ship & Bunker put the average price of VLSFO at the top 20 ports at a $263-per-ton premium to HSFO. The last time the gap was that wide was in January 2020, during the IMO 2020 fuel transition.

The wider the spread, the greater the benefit to owners of ships with scrubbers.

China to reduce port charges from April

Photo: Shenzhen Port

China’s Ministry of Transport and National Development and Reform Commission jointly issued notice to reduce port charges starting from 1 April.

Implementing a decision by an executive meeting of the State Council’s to reduce and combine port charges, Ministry of Transport and National Development and Reform Commission issued measures to reduce shipper and ship owner’s logistics expenses and promote the optimization of port business environment.

According to the notice, port infrastructure security fee will no longer set by government and will be combined into port operation charges.

Pilotage fee for international vessels at 18 coastal ports will be reduced, including the port of Shenzhen, Meizhouwan, Rizhao, Jinzhou, Shanghai, Ningbo-Zhoushan, Dalian, Tangshan, Qingdao, Lianyungang, Zhanjiang, Fuzhou, Fangcheng, Weihai, Huanghua, Yantai, Xiamen and Quanzhou. The total reduced charges for those ports are estimated to be around RMB320m per year.

The notice also mentioned to optimize charges policy for China-flag tugboats servicing for Yangtze river ports and expand the ship owner’s autonomous rights to decide whether to use the tugboat or not.

Port delays are getting worse in Shanghai. That’s very bad news for global supply chains

Hong Kong (CNN Business)China’s strict lockdown inShanghai is heaping even more pressure on global supply chains.

On Friday, Shanghai extended restrictions in many parts of the city, which is home to China’s financial hub and one of the world’s busiest ports. The Port of Shanghai had already been suffering from major holdups, and the extension may worsen congestion and increase transportation costs further, experts said.

The coastal city imposed a two-phase lockdown on its 25 million residents earlier this week. Authorities placed the western part of the city under lockdown on Friday, and extended an existing lockdown in eastern neighborhoods with positive cases by up to nine days.

Shanghai to lock down each half of city for mass Covid-19 testing

These restrictions have caused major delays at Shanghai port, which is in the eastern part of the city and was already congested. It is the world’s busiest container port, handling more than four times the volume seen at the Port of Los Angeles in 2021, according to data from both cities’ port authorities.

VesselsValue, a global shipping data provider, said the number of ships waiting to load or discharge at Shanghai’s port had skyrocketed to more than 300 this week, a near five fold increase in the past two and half weeks.

“Congestion at Shanghai usually worsens at this time of year. However, the recent increase is far higher than both last year and normal seasonal levels,” the firm said in a statement on Tuesday.

It remains unclear what impact the lockdown will have on the port’s vessel backlog, the firm said. But it suggested that supply chain managers and analysts around the world “start planning for knock on effects.”

A Covid-19 spike like the one in China is unlikely in the US, experts say. Here’s why

Maersk, one of the world’s largest container shipping companies, also said the Shanghai lockdown can cause transportation delays and higher costs.

“Trucking service in and out [of] Shanghai will be severely impacted by 30% due to a full lockdown on Shanghai’s Pudong and Puxi areas,” Maersk said in an advisory to clients on Monday. Shanghai is separated into two parts, Pudong and Puxi, by the Huangpu River.

“Consequently, there will be longer delivery time and a possible rise in transport costs,” it added.

The city’s government, meanwhile, has said that freight operations will remain normal under the lockdown.

Shanghai International Port Group, which runs the port, said last month that it would implement a “closed-loop system” that requires employees to stay in specific areas and adhere to certain protocols to prevent the spread of coronavirus.

However, due to the travel restrictions, extended waits at checkpoints, coronavirus test requirements, and potential quarantine upon return, many truck drivers are struggling to get the cargo containers delivered in and out of the port on time, according to state-controlled media outlet The Paper.

A global issue

Congestion in Shanghai is bad news for consumers and companies around the world.

“The citywide lockdown in Shanghai is a setback to global supply chains already stretched by geopolitical tensions,” wrote Bansi Madhavani, senior economist for ANZ Research, in a report on Friday.

Global supply chains have been strained for months due to the Covid-19 pandemic and Russia’s invasion of Ukraine.

Although the Shanghai port remains operational, activities such as warehousing and staffing will be affected, causing delays, he said, adding that cross-country transportationmay be hindered too.

“These restrictions could … send freight rates soaring,” Madhavani said.

Nomura analysts also expect “additional shipping delays, port -congestions and logistics undercapacity” as Shanghai remains in lockdown.

“Markets so far have underestimated the severity of the situation in China,” Nomura analysts said Thursday in a research note. “In the next couple of months, we expect global investors to better reflect these shocks in their valuations of various asset classes.”

— CNN’s Beijing Bureau contributed to this report.